Thinking of buying, selling, or refinancing?

Interest rates signify the costs associated with borrowing money within a specified period. Elevated rates result in increased interest obligations for those borrowing. Reduced mortgage rates, on the other hand, improve the feasibility of acquiring homes.

Although mortgage expenses are closely tied to interest rates, the sale prices of homes do not consistently correspond with these rates.

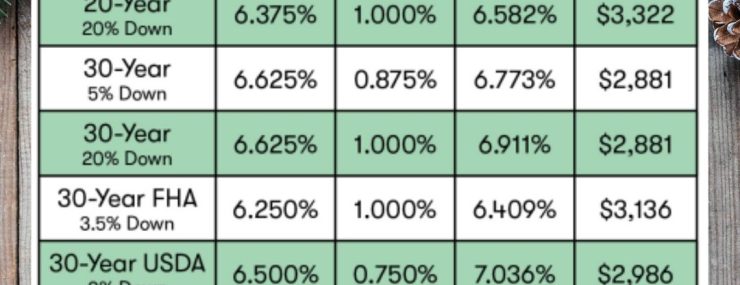

Thank you, Sidney Stonecypher at People’s Bank Home Loan Center for the rates. If you have any mortgage questions you can reach her at 360-650-5365!

*Monthly sample payments are based on a loan amount of $400,000, 780 or higher credit score, and a 45-day lock term. Actual payment obligation may be higher since sample payment amount does not include property taxes, hazard insurance, or monthly mortgage insurance (if required).