Your home is ready for an update just like you! Fortunately, you can get a freshlook for your living room without major changes or breaking the bank. Hereare 5 cool modern accents you can use to update your living room this weekend. Continue Reading about 5 Modern Details to Update Your

Traditional Living Room

Blog

5 Modern Details to Update Your

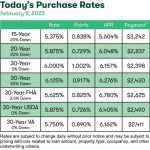

Today’s Purchase Rates Are Here!

Thinking of buying, selling, or refinancing? See What These Numbers Mean For You! Interest rates are the rates at which money can be borrowed for a set period of time. The higher the rate, the more money a borrower must pay in the form of interest on the loan. When mortgage rates are lower, this makes the purchasing of a home more affordable. Although the cost of mortgages is Continue Reading about Today’s Purchase Rates Are Here!

Lower Mortgage Rates Are Bringing Buyers Back to the Market

As mortgage rates rose last year, activity in the housing market slowed down. And as a result, homes started seeing fewer offers and stayed on the market longer. That meant some homeowners decided to press pause on selling. Now, however, rates are beginning to come down—and buyers are starting to reenter the market. In fact, the latest data from the Mortgage Bankers Continue Reading about Lower Mortgage Rates Are Bringing Buyers Back to the Market

Home Maintenance Tips for February

You may be wishing for Spring, but as the days may be getting shorter the cold isn't gone just yet! Consider spending this time sprucing up the indoors and keeping up with maintenance items now so you will be ready to focus on the outdoors when the weather breaks. Before you know it we'll all have flowers in our gardens again and will be wishing for a cool break from the summer sun. Check Continue Reading about Home Maintenance Tips for February

Why It Makes Sense To Move Before Spring

Spring is usually the busiest season in the housing market. Many buyers wait until then to make their move, believing it’s the best time to find a home. However, that isn’t always the case when you factor in the competition you could face with other buyers at that time of year. If you’re ready to buy a home, here’s why it makes sense to move before the spring market picks up. Spring Should Continue Reading about Why It Makes Sense To Move Before Spring

The 3 Factors That Affect Home Affordability

If you’ve been following the housing market over the last couple of years, you’ve likely heard about growing affordability challenges. But according to experts, the key factors that determine housing affordability are projected to improve this year. Selma Hepp, Executive, Deputy Chief Economist at CoreLogic, shares:

“. . . with slowly improving affordability and a more Continue Reading about

The 3 Factors That Affect Home Affordability

What Do These Numbers Mean?

Thinking of buying, selling, or refinancing? See What These Numbers Mean For You! Interest rates are the rates at which money can be borrowed for a set period of time. The higher the rate, the more money a borrower must pay in the form of interest on the loan. When mortgage rates are lower, this makes the purchasing of a home more affordable. Although the cost of mortgages is Continue Reading about What Do These Numbers Mean?

Want To Sell Your House? Price It Right.

Last year, the housing market slowed down in response to higher mortgage rates, and that had an impact on home prices. If you’re thinking of selling your house soon, that means you’ll want to adjust your expectations accordingly. As realtor.com explains: “. . . some of the more prominent pandemic trends have changed, so sellers might wish to adjust accordingly to get Continue Reading about Want To Sell Your House? Price It Right.