With all the headlines and talk in the media about the shift in the housing market, you might be thinking this is a housing bubble. It’s only natural for those thoughts to creep in that make you think it could be a repeat of what took place in 2008. But the good news is, there’s concrete data to show why this is nothing like the last time. There’s Still a Shortage of Homes on the Continue Reading about Why Today’s Housing Market Isn’t Like 2008

Blog

Should You Still Buy a Home with the Latest News About Inflation?

While the Federal Reserve is working hard to bring down inflation, the latest data shows the inflation rate is still high, remaining around 8%. This news impacted the stock market and added fuel to the fire for conversations about a recession. You’re likely feeling the impact in your day-to-day life as you watch the cost of goods and services climb. Continue Reading about Should You Still Buy a Home with the Latest News About Inflation?

What’s Ahead for Home Prices?

As the housing market cools in response to the dramatic rise in mortgage rates, home price appreciation is cooling as well. And if you’re following along with headlines in the media, you’re probably seeing a wide range of opinions calling for everything from falling home prices to ongoing appreciation. But what’s true? What’s most likely to happen moving forward? While Continue Reading about What’s Ahead for Home Prices?

Hello Mortgage Rates!

Thinking of buying, selling, or refinancing? See What These Numbers Mean For You! Interest rates are the rates at which money can be borrowed for a set period of time. The higher the rate, the more money a borrower must pay in the form of interest on the loan. When mortgage rates are lower, this makes the purchasing of a home more affordable. Although the cost of mortgages is Continue Reading about Hello Mortgage Rates!

The Long-Term Benefit of Homeownership

Today’s cooling housing market, the rise in mortgage rates, and mounting economic concerns have some people questioning: should I still buy a home this year? While it’s true this year has unique challenges for homebuyers, it’s important to factor the long-term benefits of homeownership into your decision. Consider this: if you know people who bought a home 5, 10, or even 30 years Continue Reading about The Long-Term Benefit of Homeownership

How To Prep Your House for Sale This Fall

Today’s housing market is different than it was just a few months ago. And if you’re thinking about selling your house, that may leave you wondering what you need to do differently as a result. The answer is simple. Taking the time upfront to prep your house appropriately and create a solid plan can help bring in the greatest return on your investment. Here are a few Continue Reading about How To Prep Your House for Sale This Fall

If You’re Thinking of Selling Your House This Fall, Hire a Pro

Today’s market is at a turning point, making it more essential than ever to work with a real estate professional. Not only will a trusted real estate advisor keep you updated and help you make the best decisions based on current market trends, but they’re also experts in managing the many aspects of selling your house. Here are five key reasons why working with a real estate Continue Reading about If You’re Thinking of Selling Your House This Fall, Hire a Pro

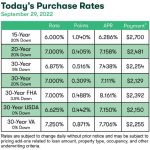

The End of September Mortgage Rates

Thinking of buying, selling, or refinancing? See What These Numbers Mean For You! Interest rates are the rates at which money can be borrowed for a set period of time. The higher the rate, the more money a borrower must pay in the form of interest on the loan. When mortgage rates are lower, this makes the purchasing of a home more affordable. Although the cost of mortgages is Continue Reading about The End of September Mortgage Rates